Explore Specialist Financing Providers for a Smooth Loaning Experience

In the world of monetary deals, the mission for a seamless borrowing experience is frequently searched for yet not conveniently attained. Professional finance solutions supply a path to navigate the complexities of loaning with precision and competence. By aligning with a reliable financing copyright, people can unlock a wide range of advantages that prolong beyond plain monetary transactions. From customized funding services to tailored support, the world of specialist car loan solutions is a realm worth discovering for those seeking a loaning journey marked by effectiveness and simplicity.

Benefits of Specialist Loan Solutions

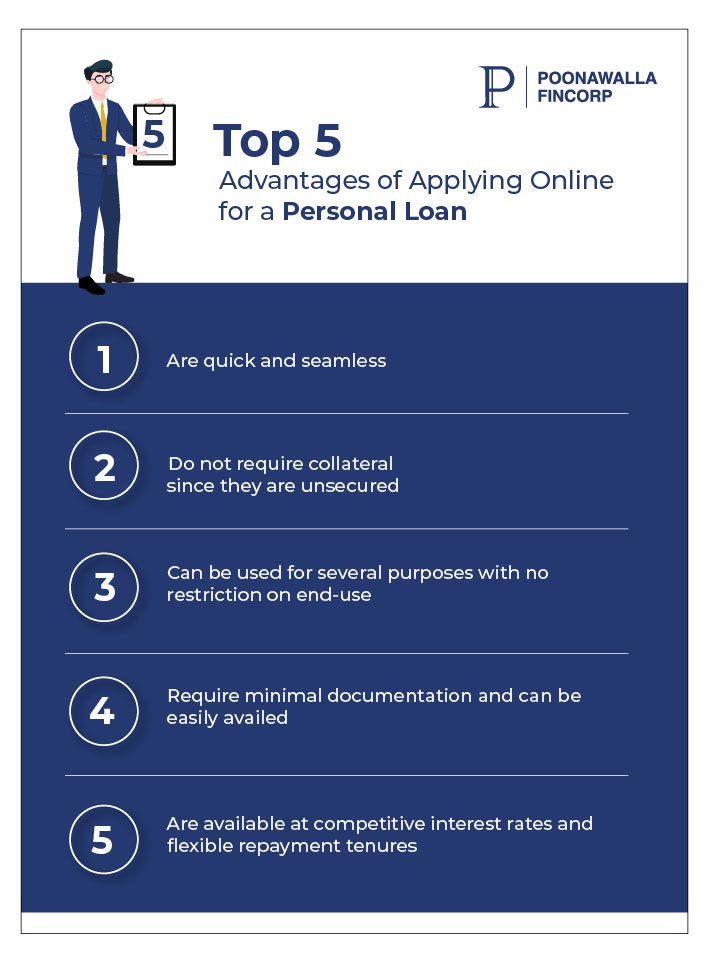

Professional loan solutions offer experience in browsing the facility landscape of loaning, giving customized services to meet particular economic requirements. Expert funding solutions commonly have developed partnerships with loan providers, which can result in faster authorization processes and better negotiation end results for debtors.

Picking the Right Funding Company

Having recognized the advantages of expert car loan services, the following crucial action is picking the best loan company to fulfill your specific economic needs efficiently. best mca lenders. When choosing a loan supplier, it is important to take into consideration numerous vital aspects to ensure a smooth borrowing experience

To start with, review the credibility and reputation of the lending supplier. Research consumer evaluations, rankings, and testimonies to determine the contentment degrees of previous customers. A reputable lending supplier will have transparent terms and conditions, superb client service, and a track document of integrity.

Second of all, contrast the rates of interest, fees, and repayment terms offered by various loan suppliers - mca funders. Try to find a service provider that uses competitive prices and adaptable settlement options customized to your monetary circumstance

In addition, take into consideration the funding application procedure and authorization duration. Opt for a company that supplies a streamlined application procedure with fast approval times to gain access to funds without delay.

Improving the Application Refine

To enhance efficiency and ease for applicants, the funding service provider has actually executed a structured application process. One vital function of this streamlined application process is the online system that enables candidates to send their info electronically from the comfort of their very own homes or offices.

Recognizing Loan Terms and Conditions

With the streamlined application procedure in location to streamline and speed up the loaning experience, the next crucial action for candidates is acquiring a comprehensive understanding learn this here now of the funding terms and conditions. Recognizing the terms and conditions of a financing is important to make certain that borrowers are mindful of their responsibilities, civil liberties, and the overall expense of loaning. By being educated about the financing terms and conditions, debtors can make audio financial decisions and browse the borrowing procedure with self-confidence.

Optimizing Loan Approval Possibilities

Safeguarding approval for a car loan demands a critical approach and extensive prep work on the part of the customer. To make best use of lending approval possibilities, people should start by evaluating their debt records for precision and resolving any type of disparities. Keeping an excellent credit rating score is essential, as it is a significant aspect thought about by loan providers when examining creditworthiness. Furthermore, decreasing existing financial obligation and preventing handling new debt before using for a finance can show monetary obligation and improve the chance of authorization.

In addition, preparing a detailed and reasonable budget plan that lays out earnings, expenditures, and the suggested car loan repayment plan can showcase to lenders that the debtor is capable of taking care of the additional economic obligation (best merchant cash advance companies). Providing all necessary documentation promptly and accurately, such as evidence of earnings and employment history, can improve the approval process and infuse self-confidence in the lender

Final Thought

Finally, expert car loan services offer numerous advantages such as skilled support, tailored lending options, and increased authorization opportunities. By picking the ideal funding company and understanding the terms and conditions, borrowers can streamline the application procedure and guarantee a seamless loaning experience (Loan Service). It is very important to very carefully take into consideration all facets of a lending prior to devoting to make certain financial stability and successful payment

Comments on “Financial Assistant: Assisting You Towards Your Monetary Goals”